In a prime flow within the banking place, the Competition Commission of India (CCI) has granted acclaim for the merger of Fincare and AU Small Finance Bank Limited (AU). This proposed union consists of bringing collectively Fincare Small Finance Bank Limited (Fincare) and AU, with AU rising as the surviving entity.

AU Small Finance Bank, a famous participant inside the banking industry, offers a numerous range of private and business banking services, protecting deposits, loans, debit and credit card services, institutional banking, and digital banking.

AU additionally holds a huge AD-II bank class license, permitting it to have interaction in forex transactions. The economic group is actively worried in distributing coverage and investment merchandise, which include mutual price range and portfolio management services.

Fincare Small Finance Bank, on the turn aspect, is a specialised banking entity offering deposit offerings like financial financial savings accounts, cutting-edge money owed, constant deposits, and ordinary deposits. The financial institution additionally extends lending services, inclusive of retail and microfinance loans, and gives virtual banking offerings. Fincare’s offerings additionally embody the distribution of coverage products.

The assertion of the merger modified into made by manner of AU Small Finance Bank on October 30, with the effective date set for February 1, 2024. However, the of completion of this transaction is scenario to approval from the Reserve Bank of India (RBI), which stays pending.

The a success merger hinges on numerous crucial situations, inclusive of approval from the shareholders of both Fincare Small Finance Bank and AU Small Finance Bank, regulatory clearance from the RBI and the CCI, and a capital injection of Rs seven hundred crores with the aid of using the promoters of Fincare Small Finance Bank.

Read More: Merger of Fincare and AU

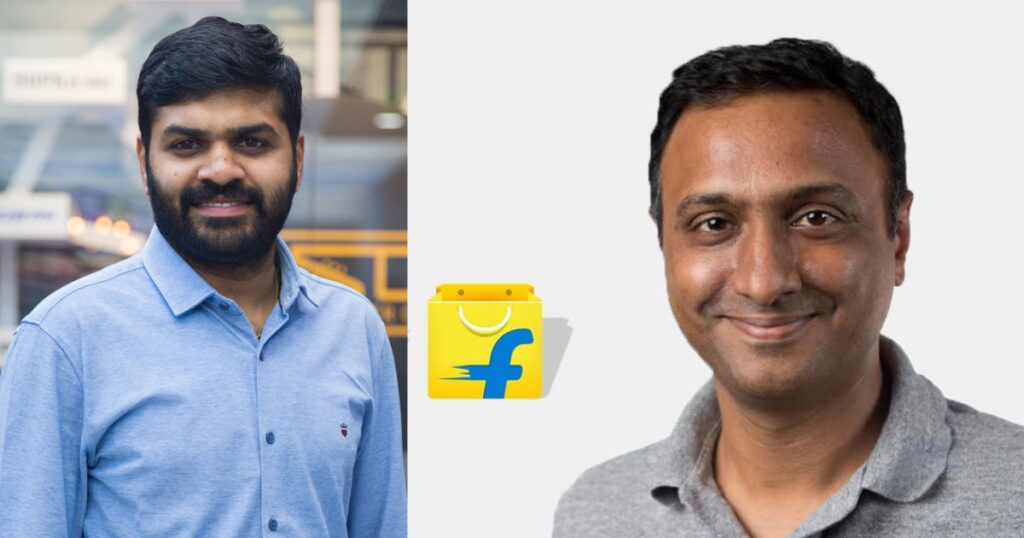

As a part of this strategic amalgamation, the Managing Director & CEO of Fincare Small Finance Bank is poised to step into the location of Deputy CEO at AU Small Finance Bank. This flow is anticipated to leverage the collective knowledge and revel in of every entities, fostering synergies that would really impact operational overall performance and boom.

Moreover, to strengthen the management organization, Divya Sehgal, a present day director on Fincare Small Finance Bank’s board, is about to sign up for the board of AU Small Finance Bank. This addition is predicted to beautify strategic choice-making capabilities and the general governance framework of the merged entity.

The approval from the Competition Commission of India shows a noteworthy milestone inside the merger way, paving the manner for the consolidation of Fincare Small Finance Bank and AU Small Finance Bank. Upon of entirety, the merged entity is poised to end up a miles higher and different banking enterprise, presenting an expanded suite of financial services to its customers.

This improvement is cautiously monitored through industry professionals and stakeholders as it represents a large transformation in the panorama of small finance banks in India.

About AU Small Finance Bank

AU Small Finance Bank is a private Indian bank known for its high-interest savings accounts (up to 7.25% p.a.), diverse credit card options, and digital banking convenience. They primarily cater to underbanked segments, offering loans, wealth management, and other financial services through a growing network of branches and online platforms.

Last Updated on 9 months