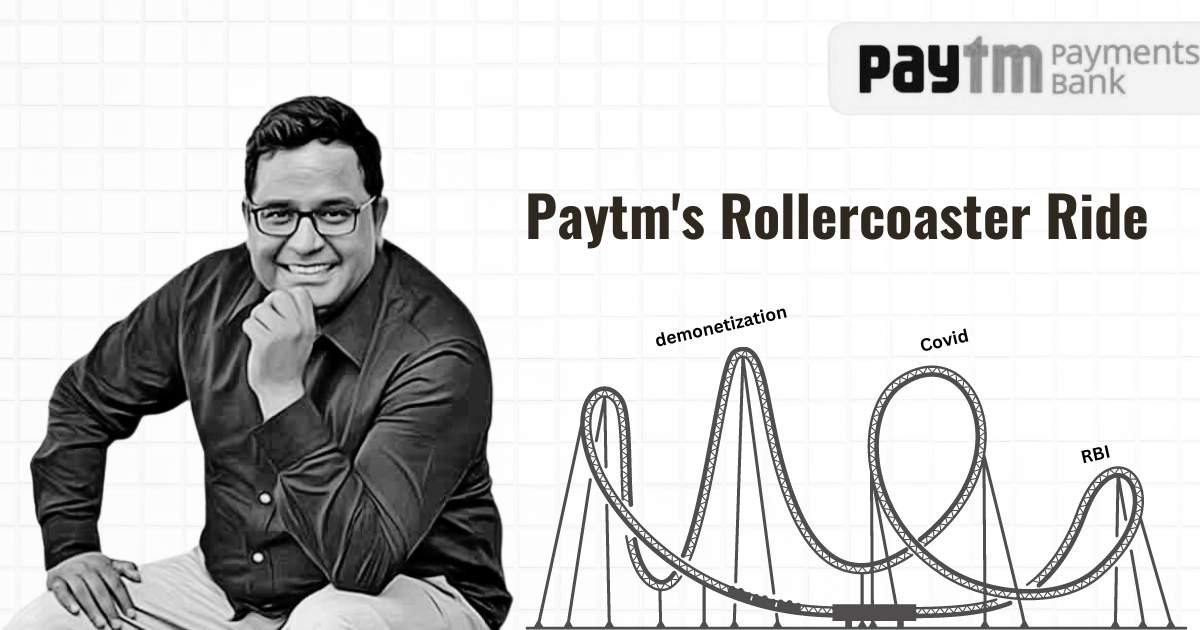

Paytm, an acronym for “Pay Through Mobile,” has been a major player in India’s digital payments and financial services landscape. However, the company is currently facing a roadblock as the Reserve Bank of India (RBI) has imposed a rule to halt its Paytm Payment Bank service. This unexpected move has left the company and its millions of users in a state of confusion and uncertainty.

Paytm, founded in 2010 by Vijay Shekhar Sharma under One97 Communications with an initial investment of $2 million, started off as a prepaid mobile and DTH recharge platform. Over the years, it expanded its services to include debit card, postpaid mobile, and landline bill payments, gaining popularity among Indian consumers who were increasingly looking for convenient online payment options.

Also Read: Indian UPI Payments Go Global with Launch at Eiffel Tower

In 2014, Paytm launched the Paytm Wallet, which quickly gained traction with partnerships like Indian Railways and Uber. This move marked a shift towards becoming a broader financial platform. The company ventured into e-commerce, offering online deals and bus ticketing, further solidifying its position in the market.

Paytm’s growth and diversification were further boosted by significant funding rounds, including $10 million from Sapphire Ventures in 2011 and a whopping $50 million from Alibaba in 2015. The company seemed unstoppable, with its user base growing to over 300 million registered users processing millions of transactions daily.

However, the tide turned when the Indian government implemented the demonetization initiative in 2016, which aimed to reduce the country’s reliance on cash and promote digital payments. This move had a significant positive impact on Paytm, as more and more Indians turned to digital payment solutions. The company seized this opportunity to expand its services, offering movie ticket bookings, travel bookings, bill payments, microloans, and even buy now, pay later options.

Despite its success, Paytm faced its fair share of challenges. Regulatory hurdles and competition from other players in the fintech sector presented obstacles for the company. Additionally, Paytm has faced controversies related to data privacy and allegations of unfair business practices, tarnishing its reputation in some circles.

Also Read: Are You Aware of These RBI Guidelines for Licensing of Payments Banks? Must Know Now!

Now, the recent imposition of the RBI rule halting Paytm’s Payment Bank service has caused further concern for the company. The exact reasons behind this decision remain undisclosed, leaving Paytm and its users searching for answers. The suddenness of the rule has raised questions about the future of Paytm and the impact it will have on India’s digital payments market.

Paytm has not taken this setback lightly. The company is determined to adapt and evolve to maintain its position in the dynamic Indian digital payments market. Paytm’s headquarters in Noida, India, remains a hub for its operations, and the company is exploring further expansion into international markets. However, the immediate focus for Paytm is finding a resolution to the RBI’s decision and restoring its payment bank service.

As of today, February 6, 2024, Paytm’s future remains uncertain. The company’s struggle with the RBI rule poses challenges that it must overcome to regain its momentum. Paytm’s millions of users eagerly await updates and hope for a positive resolution that will allow them to continue availing the convenient digital payment services Paytm has become synonymous with.

Summary of Paytm’s Thrilling Journey!

- Paytm was founded in 2010 by Vijay Shekhar Sharma under One97 Communications with an initial investment of $2 million.

- It started off as a prepaid mobile and DTH recharge platform, catering to a growing need for convenient online payment options.

- Paytm expanded in 2013 to include debit card, postpaid mobile, and landline bill payments.

- In 2014, it launched the Paytm Wallet, gaining traction with partnerships like Indian Railways and Uber.

- Paytm entered e-commerce with online deals and bus ticketing, marking a shift towards becoming a broader financial platform.

- It secured significant funding rounds, including $10 million from Sapphire Ventures in 2011 and $50 million from Alibaba in 2015.

- The Indian government’s demonetization initiative in 2016 led to a surge in digital payments, significantly benefiting Paytm.

- Paytm expanded services to include movie ticket booking, travel bookings, bill payments for utilities and other services, microloans, and buy now, pay later options.

- Paytm faced regulatory challenges and competition from other players but remains a leading force in India’s fintech sector.

Also Read: Why RBI orders Paytm Payments Bank to Stop FASTag, Wallet Services

Last Updated on 9 months