Menu

Overall Rating

10M+ Download

35%

2.7

247K reviews

Interest Rate:

Customer Care Experience:

Approval Time:

Security and Privacy Measures:

User-Friendly Interface:

Value for Money:

Check Your Eligibility

CASHe Loan Review

Do you want to borrow money quickly and easily? Do you have an urgent need, a big expense, or a holiday plan? If yes, then you should try CASHe, a famous app in India that gives instant loans from Rs.15,000 to Rs.4,00,000 for up to 1.5 years.

In this CASHe loan app review, we will explain everything about this app, such as its benefits, costs, requirements, advantages and disadvantages, and what other customers say. Keep reading to see if CASHe is a good option for you.

CASHe Personal Loan Detail

CASHe is an online place where you can get a loan. It was created in 2016 by a Singapore company named TSLC PTE Ltd. CASHe uses an AI-based credit scoring system called Social Loan Quotient (SLQ) that analyzes your social media presence, smartphone data, education, income, and other factors to determine your creditworthiness.

CASHe claims it can approve and give you a loan in minutes, without any physical papers or security. You can apply for a loan from CASHe by using their app, which you can use on Android and iOS phones.

Features of CASHe Loan App

- Personal loans from Rs.1,000 to Rs.4,00,000

- Flexible repayment tenure from 90 days to 540 days

- Interest rate starting from 9.99% p.a.

- No processing fee or foreclosure charges

- 100% paperless and digital process

- Option to avail credit line for multiple loans

- Loyalty rewards program for regular customers

- Option to pay later for online shopping and travel bookings

CASHe Personal Loan Interest Rates

The interest rate of CASHe personal loan starts from 9.99% p.a. and can go up to 36% p.a. But there are many other factors depending on which you can get loans at different types of interest rates. These factors are loan amount, tenure, and your CIBIL.

How Much Personal Loan Can I Get from CASHe?

The loan amount from CASHe personal loan ranges from ₹1,000 to ₹4,00,000 for tenures of up to 1.5 years.

Is CASHe Loan App Real or Fake

CASHe loan app is a real and legal app that gives loans online. It has a license from the RBI. Some customers are satisfied after taking out a loan from this app, but Some customers who used the app said that they faced problems related to loan amount, disbursement, customer experience etc.

Before Using this App you should do research carefully and not give your personal or money details to anyone. You should also read the rules carefully before you take a loan and take legal help if you face anything wrong.

CASHe Personal Loan Pros and Cons

If you use this app then it may have some advantages and disadvantages. Below are some pros and cons based on user reviews:

Pros:

- Quick and easy application and approval process

- No collateral or guarantor required

- Low interest rates compared to other lenders

- Option to avail credit line for multiple loans

- Option to pay later for online shopping and travel bookings

- Loyalty rewards program for regular customers

Cons:

- Limited loan amount and tenure

- High penalty charges for late payment or default

- Requires access to your smartphone data and social media accounts

- Less regulated and more risky than traditional lenders

- Negative customer reviews and complaints

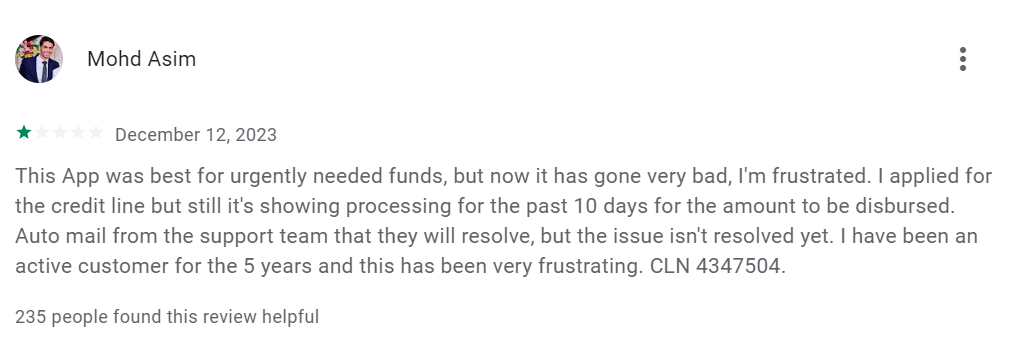

CASHe Personal Loan App Google Review

CASHe personal loan app has a rating of 3.5 stars out of 5 on Google Play Store, based on over 50,000 reviews. The app has received mixed feedback from the customers, with some praising its speed, convenience, and customer service, while others complaining about its high charges, technical glitches, and harassment. Here are some feedback from customers, both positive and negative:

Positive Reviews:

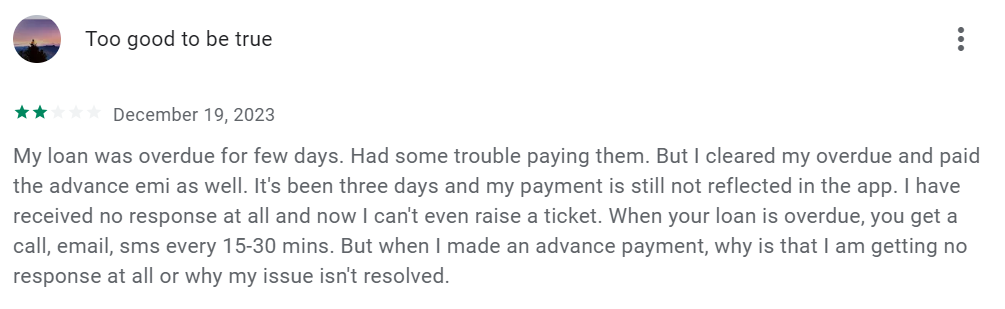

Negative Reviews:

CASHe Personal Loan Eligibility

To be eligible for a CASHe personal loan, you need to meet the following criteria:

- Applicant should have Indian Nationality

- Applicable age between 23 to 58 years old

- You should be a salaried employee of a registered company or a self-employed professional

- Minimum monthly salary Rs.15,000

- An active Facebook, LinkedIn, or Google+ account is required.

- Valid PAN card ID and Aadhaar card

- Bank account and a smartphone

Documents Required for Availing CASHe Personal Loan

The following documents are necessary to apply for a CASHe personal loan:

- PAN card as photo identity proof

- Aadhaar card as identity and address proof

- Latest salary slip as income proof

- Bank statement of the last 3 months as income and bank account proof

You need to upload these documents on the CASHe app and complete the verification process to get your loan approved.

CASHe Loan Customer Care Number

If you want to contact CASHe App to solve any problem, then let me tell you that there is no landline number available to contact this app, but the company has provided some support mail ID on which you can contact. Which is as follows.

- Mobile application related issues: support@CASHe.co.in

- Loan related issues: support@CASHe.co.in

- Payment related issues: support@bhanix.in

- CIBIL related issues: support@CASHe.co.in

- NOC related issues: support@bhanix.in

Check Your Cibil Score in Free

How to Apply for CASHe Personal Loan?

The application process of CASHe personal loan is simple and fast. You can follow these steps to apply for a loan on the CASHe app:

- Download the CASHe app from Google Play Store or Apple App Store

- Register yourself using your Facebook, LinkedIn, or Google+ account

- Fill the application form and upload the required documents

- Enter the loan amount and tenure you require.

- Check your SLQ score and loan eligibility

- Accept the loan agreement and terms and conditions

- Get your loan approved and disbursed to your bank account within minutes

Calculate Cashe Personal Loan EMI

Conclusion

CASHe loan app is a convenient and reliable way to get a personal loan for your short-term needs. It offers loans at low interest rates and with flexible repayment options. It also has a credit line feature that allows you to avail multiple loans with one approval.

However, you should also be aware of the risks and drawbacks of using this app, such as high penalty charges, data privacy issues, and customer complaints. You should also compare other loan options and do your own research before applying for a loan.

We hope this CASHe loan review has helped you understand the app better and make an informed decision. If you have any questions or feedback, please feel free to share them in the comments section below.

FAQs

CASHe loan approved but not credited issue is a problem faced by some customers who applied for a loan from CASHe, but did not receive the loan amount in their bank account, even after getting a confirmation message from CASHe. This issue may be caused by technical glitches, bank delays, or incorrect bank details. Customers can contact CASHe customer care to resolve this issue.

CASHe is a safe and legitimate personal loan app that is registered as a NBFC and regulated by the RBI. CASHe uses a proprietary technology called Social Loan Quotient to assess the creditworthiness of borrowers, and offers loans.

To cancel a loan with CASHe, you have to meet the terms and conditions as set by the lender. Most lenders allow pre-closures only after a certain period, say 6-12 months of continuous payment of the EMI. You also have to give a foreclosure intimation of 30 days to the lender. You can contact the CASHe branch from where you procured the loan, and provide the relevant documents.

Yes, you can foreclose a CASHe loan without paying any extra fees or charges. CASHe does not charge any penalty for preclosure or part-payments. You can contact the CASHe branch from where you took the loan, and pay the outstanding loan amount along with the interest.

Check Your Eligibility

Vishal Kumar

Vishal is a content writer who writes articles on various topics and is currently working as a writer on loan, banking, and business related financial topics on LOANPANDIT website. Vishal works to explain financial concepts to the readers in a very simple way through his attractive and informative articles. Their goal is to empower people to make financial decisions.

Related Posts

Bank Personal Loan Eligibility Criteria

Bank Personal Loan Interest Rate

लोन के लिए तुरंत अप्लाई करने के लिए लिंक पर जाये

फॉलो करें

ब्लॉग पर सब्सक्राईब करें

लोन, इंटरेस्ट रेट, बैंक लोन, सरकारी स्कीम स्कीम, और फिनांशियल विषय से जुड़े अपडेट पाने के लिए सब्सक्राईब करें