Menu

Overall Rating

1Cr+ Download

93%

4.7

21.4L reviews

Interest Rate:

Customer Care Experience:

Approval Time:

Security and Privacy Measures:

User-Friendly Interface:

Value for Money:

Money View Loan Review

Have you ever faced a situation where you needed money urgently but did not have enough savings or a good credit score to get a personal loan? If yes, then you are not alone.

Many people in India struggle to access formal credit due to various reasons, such as low income, lack of credit history, or poor credit score. But what if there was a way to get a personal loan quickly and easily without any hassle? That’s where Money View comes in. Money View is a digital lending app that provides personal loans to customers who may not qualify for traditional loans.

With Money View loan, you can get money in your bank account with a competitive interest rate and a payment plan that suits your needs. Sounds too good to be true, right? Well, in this article, we will tell you everything you need to know about Money View.

Features and Benefits of Money View Personal Loan

Money View personal loan app comes with a host of features and benefits that make it an attractive option for anyone looking for a quick and convenient way to get a personal loan. Some of the main features and benefits of Money View are:

- Instant approval and disbursal:Get money fast and easy with the Money View app.

- Paperless and hassle-free: No papers, no visits, just upload docs on app.

- Low interest rates and flexible repayment: Low interest, flexible payment, save more.

- High loan amount and eligibility: Borrow up to 10 Lakh, even with low score.

- Secure and transparent: Safe, legal, and clear, no hidden charges.

Apply Now for 10 lakh personal loan

What is a Money View Personal Loan App?

Money View is a personal loan app that was launched in 2014 by WhizDM Innovations Pvt. Ltd., a fintech company based in Bangalore, India. Money View aims to provide easy access to credit to millions of Indians who are underserved by traditional banks and financial institutions.

Money View uses a proprietary algorithm to assess the creditworthiness of borrowers based on their income, expenses, savings, and other financial data. Money View also leverages the power of artificial intelligence and machine learning to verify the identity and documents of borrowers, and to disburse loans within minutes.

Money View offers personal loans ranging from Rs.10,000 to Rs. 10 Lakhs, with interest rates starting from 1.33% per month, and repayment tenures from 3 to 60 months. Money View claims to have over 10 million users, and to have disbursed over Rs.5,000 crore in loans so far.

Is Money View Loan App Real or Fake?

Money View loan is a real and valid app for personal loans that has been running in India since 2014. Money View is not a scam or a fraud, it is a famous and reputable brand that has received many awards and recognition for its creative and great work in the fintech sector.

Money View also has the backing of some of the top investors and partners in the industry, such as Tiger Global, Reliance Capital, Shunwei Capital, and ICICI Bank. Money View has over 10 million users who are satisfied with it, and a high rating of 4.3 out of 5 on Google Play Store.

Money View also has a friendly and fast customer support team that is open 24/7 to solve any problems or questions that the customers may have.

Apply Now for 2 lakh personal loan

Money View Personal Loan Interest Rate

The interest rate of Money View personal loan starts from 1.33% per month, and can go up to 2.5% per month. The interest rate is also fixed for the entire duration of the loan, and does not change with market fluctuations or other factors.

The interest rate is clearly mentioned in the loan agreement, and the borrower can also use the EMI calculator on the Money View app or website to estimate the interest rate and EMI for their desired loan amount and tenure.

Eligibility Criteria for Money View loan App

The eligibility criteria for Money View personal loan are simple and easy to meet. The borrower only needs to fulfill the following conditions to apply for a Money View personal loan:

- Indian citizens and above 21 years of age are required..

- A valid PAN card and Aadhaar card and a bank account in their name.

- Monthly income of at least Rs.15,000, either from salary or self-employment.

- Minimum credit score of 650 is required.

Check Your Credit Score in free

Document Required for Money View Personal Loan

The documents required for Money View personal loan are minimal and easy to upload. The borrower only needs to provide the following documents to apply for a Money View personal loan:

- PAN card and Aadhaar card:

- Bank statement in PDF format

- Selfie

Check – mPokket Personal loan Review

Money View loan App Review Pros & Cons

Money View app is one of the most popular and widely used personal loan apps in India, and has received a lot of Mix feedback and reviews from its customers. However, like any other app or service, Money View app also has some pros and cons that the customers should be aware of before using it. Here are some of the pros and cons of Money View app, based on the customer reviews and ratings on Google Play Store:

Pros

- Fast and easy: Apply for a loan in minutes, get money in 2 hours, simple and user-friendly app, quick verification and approval.

- Low and flexible: Choose loan amount and tenure, prepay without penalty, fixed and transparent interest rate.

- High and inclusive: Borrow up to Rs.10 Lakhs, low credit score or no credit history accepted, self-employed, freelancers, or salaried employees eligible.

- Secure and reliable: RBI registered NBFC, reputed and award-winning brand, strong customer support, prompt and courteous service.

Cons

- High processing fee and GST: 2.5% to 6% of loan amount plus 18% GST, not clearly disclosed or explained, deducted from loan amount before disbursal.

- Low credit limit and tenure: Depends on credit score and income, not as desired, not adjustable, even after timely repayment and improved credit score.

- Technical glitches and errors: App crashing, slow loading, OTP not received, loan status not updated, EMI not deducted, incorrect loan details, need to contact customer support.

- Poor customer service and communication: Not responsive, helpful, or courteous, do not resolve queries or issues, do not communicate clearly or proactively, do not send confirmation, notification, or reminder.

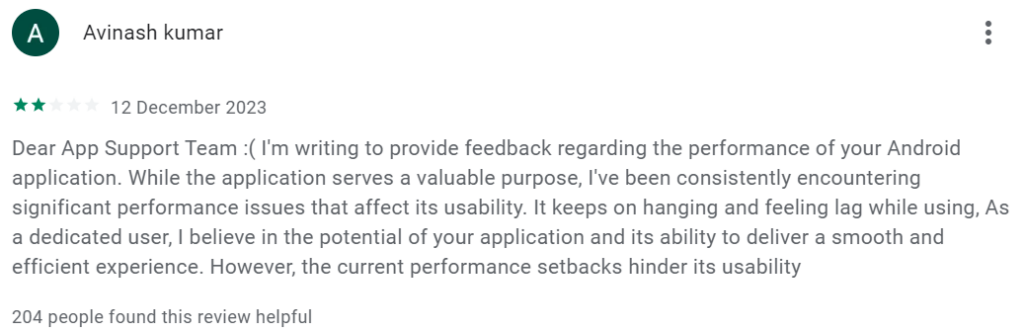

Honest Review from Google Play Store

To give you a better idea of what the customers think and feel about Money View app, here are some of the actual customer reviews and ratings from Google Play Store, as of March 2024:

Positive Review

Negative Review

Moneyview Personal Loan EMI Calculator

Process of Money View Loan Status Check Online

The process of money view loan status check is simple and easy. The customer can check their loan status anytime and anywhere on the Money View app or website. The customer only needs to follow these steps to check their loan status:

- Step 1: Log in to the Money View app or website using their registered mobile number and password.

- Step 2: Go to the ‘My Loans’ section and select the loan that they want to check.

- Step 3: View the loan details, such as loan amount, interest rate, repayment schedule, EMI amount, due date, etc.

- Step 4: Check the loan status, such as approved, disbursed, active, closed, etc.

The customer can also download their loan agreement, repayment schedule, and NOC from the app or website, if they want to.

Check- RupeeRedee Personal Loan

Money View Personal Loan Customer Care Number

Money View loan consumer complaints are the grievances or issues that the customers have with the Money View loan app or service. The customers can raise their complaints or feedback on the Money View customer care number, which is 080-4569-2002.

The customer care number is available 24/7, and the customer can call or WhatsApp the number to get in touch with the customer support team. The customer support team will try to resolve the customer’s complaint or issue as soon as possible, and provide them with a satisfactory solution..

Conclusion

Money View loan app gives you money quickly and easily. It has good interest, easy payback, big loans, and simple rules. It also uses new technology to make the loan fast, easy, and safe. But some users are unhappy with this app, like high charges, low loans, app problems, and bad service.

So, you should consider the good and bad sides of the Money View loan app before you take a loan and compare it with other loan apps. We hope this guide shows you everything about the Money View loan app and helps you choose.

Check – Cashe Personal Loan Review

FAQs - Money View Loan

Yes, Moneyview is safe and a safe digital platform that offers instant personal loans online for various purposes. It claims to be secure, hassle-free, and transparent.

Money View is not a bank or a non-banking financial company (NBFC), but a facilitator that connects borrowers with lenders. The loans are approved by RBI-registered NBFCs or banks that partner.

To cancel your Money View loan, you need to contact the customer care team of the lender that disbursed your loan. You can find the contact details in your loan agreement or on the Money View app. You may have to pay some charges for loan cancellation.

The Moneyview loan process is fast and simple. You can check your eligibility in 2 minutes, upload your documents online, and get the loan amount in your account within 24 hours of approval.

Check Your Eligibility

Vishal Kumar

Vishal is a content writer who writes articles on various topics and is currently working as a writer on loan, banking, and business related financial topics on LOANPANDIT website. Vishal works to explain financial concepts to the readers in a very simple way through his attractive and informative articles. Their goal is to empower people to make financial decisions.

Related Posts

Bank Personal Loan Eligibility Criteria

Bank Personal Loan Interest Rate

लोन के लिए तुरंत अप्लाई करने के लिए लिंक पर जाये

फॉलो करें

ब्लॉग पर सब्सक्राईब करें

लोन, इंटरेस्ट रेट, बैंक लोन, सरकारी स्कीम स्कीम, और फिनांशियल विषय से जुड़े अपडेट पाने के लिए सब्सक्राईब करें